atc income tax india

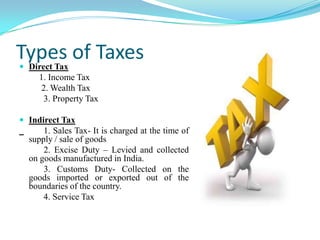

15 lakh per financial year under Section 80C of the Income Tax Act and its allied sections such as 80CCC and 80CCD. I-T notice has been issued to the wife of former PM seeking all details pertaining to the property.

Revanna on Monday said that this is nothing but political vendetta.

. 150 Lakh and you end up paying no tax on it at all. Thu Apr 07 2022 091205 AM. The amount of the advance - 200 to 500 - will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer.

Accelerated economic recovery lifted the Centres net direct tax collections for FY22 till March 16 by over 48 per cent on a year-on-year basis. A maximum of upto 10 of salary for employees or 20 of gross total income for self-employed individuals. Participating in the debate on the Appropriation Bill and the Finance Bill 2022 in the Rajya Sabha he said that the IT Act has 298 sections if one does not.

INCOME-TAX ACT 1961 43 OF 1961 AS AMENDED BY FINANCE ACT 2008 An Act to consolidate and amend the law relating to income-tax and super-tax BE it enacted by Parliament in the Twelfth Year of the Republic of India as follows CHAPTER I PRELIMINARY Short title extent and commencement. Any individual or HUF can get a tax deduction up to Rs. This means that your income gets reduced by this investment amount up to Rs.

Insertion of rule 16DD and form 56FF to the Income-tax Rules 1962. Shimla Mar 28 IANS. It states that qualifying investments up to a maximum of Rs.

New Delhi Mar 17 IANS. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. 21 This Act may be called the Income-tax Act.

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. New Delhi Mar 28 IANS.

Section 80C of Income Tax Act is applicable only for individual taxpayers and Hindu Undivided Families. Chidambaram said on Monday. It allows for a maximum deduction of up to Rs15 lakh every year from an investors total taxable income.

The Income Tax Act 1961 43 of 1961 Last Updated 13th December 2019 12607. For JE-ATC this can be approximately INR 8000 Income tax will be depending on how much. The JDS has strongly condemned the Income Tax Department notice to former Prime Minister Deve Gowdas wife Chennamma.

Public Notice regarding fraudulent appointment letter. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. 150 Lakh are deductible from your income.

Section 80C of the Income Tax Act Tax Deduction up to Rs. MUMBAI Feb 1 Reuters - India will impose a tax of 30 on income from cryptocurrencies and other digital assets finance minister Nirmala Sitharaman said while presenting the federal budget on. The official produced the accused before the concerned.

15 Lakh हद म पढ. Central Goods and Services Tax officials posted with Mumbai South have busted a fake income tax credit ITC network and arrested a proprietor of a firm for availing and passing on of fake ITC of Rs 18 crore by allegedly using bogus invoices of Rs 98 crore. Guidelines under clause 10D section 10 of the Income-tax Act 1961.

Our primary focus is in individual and business tax returns. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts.

आज क इस आरटकल म म आपक आय कर अधनयम 1961 PDF Income Tax Act 1961 PDF download क हद व इगलश दन PDF उपलबध करन ज रह ह जनह. Atc Income Tax India. Employee Contribution Under Section 80CCD 1.

Income Tax Gratuity Social Security Schemes and Pension do remember all AAI employees get Pension after retirement. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Hassan Karnataka Mar 28 IANS.

1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. Air Traffic Control is one of the most stressful jobs in the world. Here comes the real reward of being an ATC Officer in India.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD. The government must replace the Income Tax Act by the Direct Tax Code as it claims that it has dumped all old legacies former Finance Minister P.

Deve Gowdas son HD. ATC is a premier tax preparation firm with a core focus in tax services. 42022 - Deduction of Tax at Source - Income-tax Deduction from Salaries under section 192 of the Income-tax Act 1961.

ATC Income Tax is a tax preparation firm with retail offices throughout the Atlanta Metro Area. Section 80C of the Income Tax Act is the section that deals with these tax breaks. This deduction is not available to partnerships companies and other.

The amount of the advance - 200 to 500 - will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. ATC is a premier tax preparation firm with a core focus in tax services. The Himachal Pradesh High Court on Monday issued notice to the state government on a plea questioning the policy exempting ministers and legislators from paying their own income tax burdening the exchequer.

According to the Ministry of Finance net collections stood at Rs 13630383 crore compared to Rs 9184305 crore over the corresponding period of the preceding financial year. Find your nearest ATC Income Tax offices and make an appointment today. The amount of the advance 200 to 500 will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer.

A division bench of Chief Justice Mohammad Rafiq and Justice Jyotsna Rewal Dua passed this order on the petition of Yash Pal. Mumbai Apr 7 IANS. Tax deductions under Section 80CCD are categorised in three subsections.

Atc Income Tax Reviews Photos Phone Number And Address Legal Services In Georgia Nicelocal Com

Income Tax Tds Gst Filing Details With Reduced Penalty Tax Payer

Incometax Twitter Search Twitter

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Australia Vs Tech Mahindra Limited September 2016 Federal Court Case No 2016 Atc 20 582

Incometax Twitter Search Twitter

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Air Traffic Controller Salary In India Aai Atc Salary

What Will Be The In Hand Salary Per Month Of An Aai Junior Executive Quora

Mh Th Vuos Quot Kk Income Tax Department

80c Deduction Tax Deduction Under Section 80c And Tax Planning Taxguru

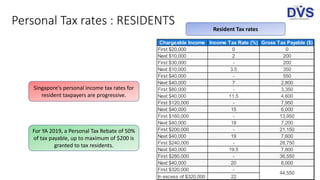

Taxation Of Individuals In Singapore

Atc Income Tax Office In The City Tirupati

Taxation Of Individuals In Singapore

Air Traffic Controller Salary In India Aai Atc Salary

What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora